Tabby is a prominent Buy Now, Pay Later (BNPL) platform that has transformed the shopping landscape in the UAE. In today’s fast-paced environment, consumers prioritize financial flexibility and convenience when making purchases, and Tabby effectively addresses these needs. The BNPL model has witnessed significant adoption in the UAE, a market renowned for its tech-savvy population and robust e-commerce growth. This payment method empowers consumers to enjoy their purchases immediately while spreading the cost over time, all without incurring any interest charges.

Tabby has emerged as a preferred choice for both shoppers and merchants, seamlessly integrating into both online and offline retail experiences. By streamlining the payment process and eliminating financial hurdles, Tabby assists consumers in managing their budgets effectively without compromising on essential or desired purchases. A key distinguishing feature of Tabby is the Tabby Card, a virtual card that further enhances the convenience of BNPL by enabling users to shop seamlessly both online and in physical stores.

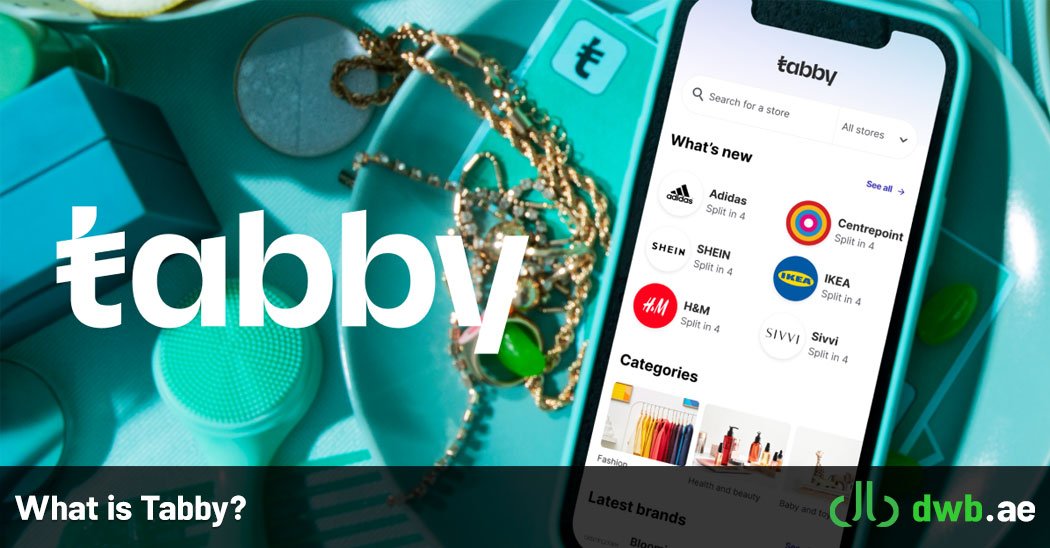

What is Tabby?

Tabby is a financial technology company that enables users to split their payments into four equal, interest-free installments. This model empowers shoppers to buy now and pay later without incurring additional costs, provided they meet their repayment deadlines. It eliminates the stress of paying large sums upfront, making shopping more accessible and manageable for consumers across different income levels.

Tabby’s services are widely available in the UAE, where it partners with an extensive network of retailers and e-commerce platforms. From fashion and beauty to electronics and home goods, Tabby collaborates with popular brands to offer a flexible payment option at checkout. This collaboration benefits merchants as well, increasing sales and customer satisfaction by providing a payment solution that aligns with modern consumer preferences.

In addition to online shopping, Tabby has expanded its services to in-store purchases through its Tabby Card. This innovative virtual card seamlessly integrates with digital wallets like Apple Pay and Google Pay, making it easier than ever for customers to enjoy the benefits of BNPL wherever they shop. Whether it’s a trendy fashion boutique or a leading electronics store, Tabby brings financial flexibility to the fingertips of UAE shoppers.

The Tabby Card

At the heart of Tabby’s success is the Tabby Card, a virtual Visa card that seamlessly integrates with the Tabby app. Unlike traditional BNPL options, which may only work with select online retailers, the Tabby Card allows users to shop at any merchant that accepts Visa, both online and in-store.

Key Features of the Tabby Card:

- Interest-Free Installments: Purchases are split into four equal payments with no added interest or fees.

- Wide Acceptance: Accepted by thousands of merchants across the UAE, from local boutiques to global brands.

- Digital Wallet Integration: The card can be added to Apple Pay or Google Pay for secure and seamless in-store transactions.

- No Physical Card: Being entirely virtual, it eliminates the need for carrying a physical card, aligning with modern, digital-first lifestyles.

- Instant Activation: Eligible users can activate their Tabby Card immediately within the app.

How Does the Tabby Card Work?

Using the Tabby Card is incredibly simple. Here’s a step-by-step guide:

- Sign Up

- Download the Tabby app on your smartphone (available on iOS and Android).

- Create an account by providing basic personal and contact details.

- Get Approved

- Complete a quick and straightforward application process to determine eligibility. Approval is based on factors such as UAE residency and spending habits.

- Activate Your Tabby Card

- Once approved, your Tabby Card will appear in the app. Activate it in just a few taps.

- Add Your Linked Card

- Link an existing debit or credit card to your Tabby account. This card will be used for the first payment and subsequent monthly installments.

- Shop

- Use the Tabby Card to shop online or in physical stores that accept Visa. You can pay directly from your smartphone if the card is linked to Apple Pay or Google Pay.

- Split Payments

- Purchases are split into four equal installments. The first payment is charged immediately, and the remaining three are automatically deducted from your linked card over three months.

Who Should Use Tabby?

Tabby is ideal for:

- Budget-conscious shoppers who want to manage their finances more effectively.

- Young professionals and millennials who prefer modern, digital-first payment methods.

- Families seeking to make high-value purchases, like furniture or electronics, without stretching their monthly budgets.

The Impact of Tabby on Retail and E-Commerce

Tabby is reshaping the retail and e-commerce landscape in the UAE. For merchants, it serves as a powerful sales tool, particularly in a competitive market where shoppers are more inclined to complete purchases with flexible payment options. By removing the barriers of upfront costs, Tabby helps retailers attract and retain customers.

The BNPL industry itself is growing rapidly in the Middle East. According to recent reports, the market is projected to grow significantly in the next five years, with Tabby leading the charge as one of the most innovative players.

Tabby’s Partnerships and Market Impact

One of the key factors behind Tabby’s rapid growth and widespread adoption in the UAE is its strategic partnerships with leading retailers and e-commerce platforms. Tabby collaborates with both global and regional brands, offering consumers a wide range of options across industries. From high-street fashion and luxury goods to electronics and lifestyle products, Tabby ensures that its services cater to diverse shopping preferences. Notable partners include names like Adidas, Ikea, Namshi, and Sephora, alongside smaller, locally renowned stores that resonate with UAE shoppers.

This extensive network not only enhances consumer convenience but also provides retailers with a competitive edge. By integrating Tabby as a payment option, merchants have reported significant increases in conversion rates, larger average order values, and reduced cart abandonment rates. Customers are more likely to complete their purchases when given the flexibility to pay in installments, which has proven to be a win-win for both shoppers and businesses.

Impact on Consumer Behavior in the UAE

Tabby’s influence on consumer behavior in the UAE is profound. With the increasing adoption of BNPL solutions, shoppers now prioritize flexibility and transparency in payment options. Tabby has helped bridge the gap between consumer aspirations and financial accessibility, allowing individuals to buy quality products without the burden of immediate full payment. This is particularly appealing in the UAE, where a cosmopolitan population values access to the latest trends and technologies.

For millennials and Gen Z shoppers, who are among the largest demographic groups in the region, Tabby aligns perfectly with their digital-first mindset and demand for financial inclusivity. Additionally, families and budget-conscious consumers also benefit from Tabby’s no-interest installment plans, enabling them to manage expenses without overextending their finances.

Boosting Local Businesses

Tabby is not just a payment solution for major international brands; it also plays a pivotal role in supporting small and medium-sized businesses (SMBs) in the UAE. By partnering with Tabby, local businesses can attract a broader customer base and compete with larger, established brands. Tabby’s user-friendly integration process and promotional support give these businesses an opportunity to thrive in a competitive market.